A whopping $29.4 trillion. This is the amount of funds needed to transform ASEAN into a region powered by 100% renewable energy. The transition to clean energy entails massive investments in new plants as well as grid expansion. And Southeast Asian nations have taken their early steps towards this goal.

The only alternative to mitigating the risks of global warming is to invest in renewable energy. The International Renewable Energy Agency (IRENA) has said that countries need to double their renewable power generation by 2030 to limit the rise in global temperature to 1.5 degrees Celsius.

When it comes to ASEAN, the member nations have set ambitious targets to build sustainable energy systems. But at the core of these strategies will be fresh infusion of funds into clean energy. IRENA has advised ASEAN regulators to develop an effective transmission and distribution network so that there is a steady flow of capital into renewables.

WHERE DOES ASEAN STAND?

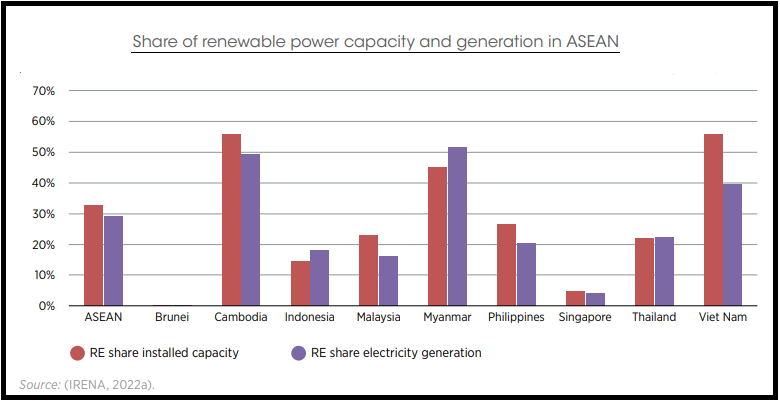

ASEAN has taken a collective pledge to decarbonise the region’s power sector. Under the ASEAN Plan of Action of Energy Cooperation, the countries have set a renewable energy share of 23% in the total primary energy supply. These nations also aspire to have a 35% share of renewable energy in ASEAN installed power capacity by 2025.

Each country has taken a series of steps to achieve the clean energy targets. Here is a glimpse of where they stand:

Singapore, which is considered a mature market, has a solar target of at least 2 gigawatt-peak (GWp) by 2030. It is also working with the US to identify clean energy partnership opportunities for ASEAN.

BEING FUTURE READY

Though ASEAN is committed towards green energy, experts believe that the region needs multiple projects and additional investments to meet the climate goals.

Vietnam, for instance, needs between $8 billion and $14 billion annually till 2030 to develop new power plants. Malaysia needs to invest at least $375 billion to achieve a net-zero target by 2050.

To achieve net zero by 2060, Indonesia will need to almost triple energy investment by 2030 from today’s level. The Philippines needs at least $121 billion of investments in renewable energy between 2020 to 2040 to attain its clean energy goals.

Interventions by the respective governments will not be enough to accomplish the net-zero and renewable energy goals. A mix of public and private funding avenues will help SEA accelerate its advance towards greener energy generation.

Thao Nguyen is ABP’s Country Manager – Vietnam. She is a dynamic leader with over 27 years of experience working for both global and local banks in Vietnam. Over the course of her career Thao has held senior leadership roles at HSBC, Citibank, ANZ, Techcombank and VIB

Stay up to update with our latest news.

Have Us Contact You