Southeast Asia nations are now paying closer attention to sustainable business practices.

Southeast Asia is growing at a breakneck pace. ASEAN is projected to become the world’s fourth-largest economy by 2050. Corporates are getting more ambitious, with rapid expansion in manufacturing and services. However, the growth also has a downside. The region risks losing 35% of its GDP to climate risks caused by rising emissions. Hence, businesses can no longer hold back on their sustainability promise.

Corporates are now paying serious attention to environmental, social, and governance (ESG) disclosures. Clean energy targets are not just on paper. Moving beyond CO2 emissions, newer concepts like sustainable finance are also seeing rapid adoption in the region.

Member nations, including Indonesia, Malaysia, Singapore, Vietnam, and Thailand, have mandatory regulations for ESG disclosures. The Philippines will make it compulsory for listed companies from 2023 onwards. Now, companies are also setting up ESG teams to monitor energy use regularly.

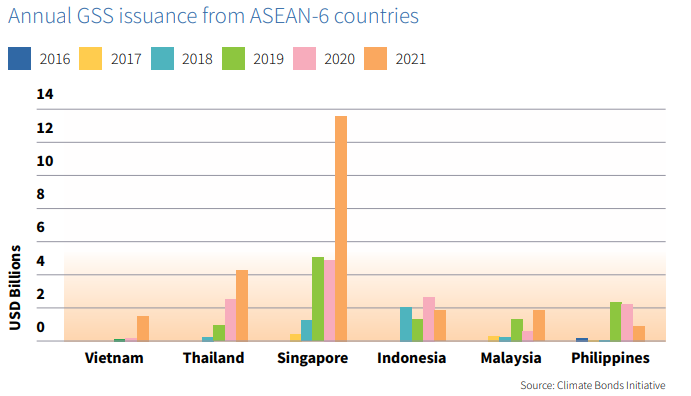

The ASEAN GSS (Green, social and sustainable bonds which are used to finance projects with a positive climate impact) issuance market has grown to a volume of 24 bn$ in 2021 compared to 13.6 bn$ the prior year.

Who leads the charts?

At present, Thailand leads ESG disclosures in Southeast Asia. The corporate governance code by the country’s markets regulator mandates sustainability reporting.

The Stock Exchange of Thailand is ranked the ninth-best stock exchange in the world for ESG disclosures. Its 2017 Corporate Governance and Stewardship Code requires disclosures that are proportionate to the company’s size and complexity and meet domestic and international standards.

Here is what the other major ASEAN nations are doing:

Vietnam: Listed companies and state-owned firms are mandated to publish an ESG report every year. This includes the amount of greenhouse gas emissions, energy, and water consumption, as well as compliance with environmental laws. In addition, the planning ministry has proposed the implementation of an industrial environmental index in Vietnam. This index will measure the level of pollution in each industrial sector.

Indonesia: From 2020 onwards, all listed companies were required to publish annual sustainability reports. Apart from this, financial services firms also need to disclose steps taken for sustainable finance. This involves taking the environment into consideration while making investment decisions. Some examples are green bonds, carbon credits, and renewable energy financing.

Philippines: ESG reporting will become obligatory from 2023. The current regime follows a comply-or-explain policy. Close to 90% of companies have complied with these regulations. The country has also launched a Sustainable Finance Framework to raise money through green bonds, and other clean instruments.

Bridging the gap

Understanding their environmental responsibilities, more companies in the region are setting up ESG teams and improving the reporting standards.

As ASEAN transforms into a major economic engine of the globe, its member nations will need to play a key role in improving transparency and identifying new opportunities in ESG. An environmentally friendly future will depend on the business decisions taken today.

Kavita Panda is our Chief Operating Officer and Country Manager for India. Kavita was Executive Director of The Walt Disney Company India, wherein, she spent a decade and half in various business roles across Content Syndication, Licensing and Merchandising, Solution Sales and Advertising Sales.

Stay up to update with our latest news.

Have Us Contact You