Cambodia’s blockchain-based payment system is aiding financial inclusion in the country.

In less than two years, Cambodia has achieved what several developed countries are only thinking about. The country’s blockchain-based payment system Bakong has reached nearly 8 million users, which is almost 50% of Cambodia’s population. There are multiple upgrades planned in order to make the payment system accessible to more citizens.

The National Bank of Cambodia’s (NBC) blockchain-driven payment that was launched in October 2020 is now being used for payment across banking, retail, and transportation. Now a unified QR code is being rolled out under Bakong.

Making a shift

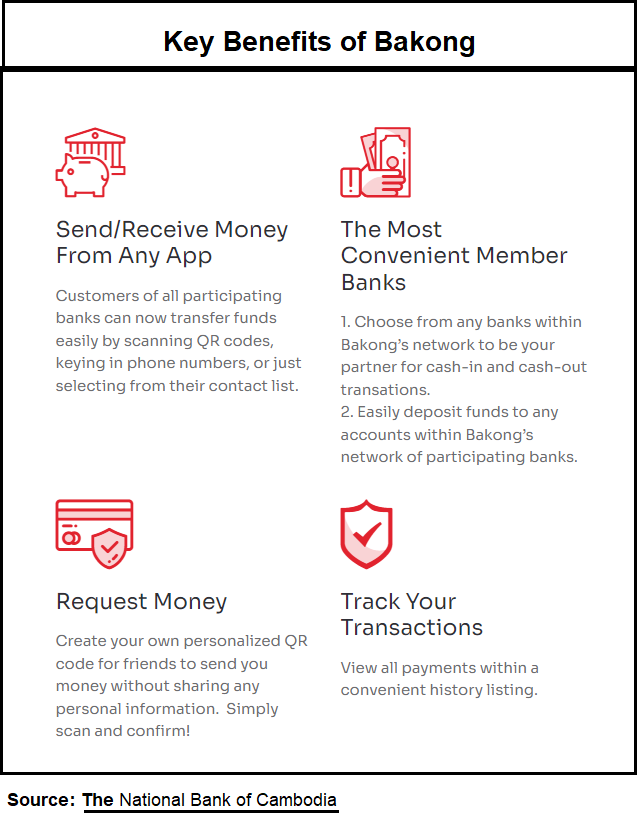

In October 2020, the Bakong payment system was introduced as an additional choice for customers to access digital financial services through their mobile. These were useful in places where ATMs or POS terminals were not in place. Within Bakong, all financial institutions and payment providers are connected under a single payment platform. Fund transfers happen in real-time.

Users don’t need a bank account to register for Bakong, so even rural customers with limited internet access can avail of the facility. Because of the ease of access, over 200,000 previously unbanked Cambodians use a Bakong e-wallet.

The QR code addition is expected to boost all categories of retail payments in Cambodia, including e-commerce. The primary target audience is the unbanked, who have been left out of the traditional banking systems for years.

Of the 8 million people who are connected to Bakong users, there are 297,000 registered users. These are Cambodian residents who were previously not connected to the traditional banking system.

Building a connected future

Taking a cue from the expansion of Bakong, blockchain venture capital firms have also evinced interest in entering Cambodia.

Under the National Financial Inclusion Strategy 2019-25, Cambodia wants to increase usage of formal financial services from 59% to 70% by 2025, and reduce the financial exclusion of women from 27% to 13%.

NBC is adding a layer of electronic KYC and open API to increase cross-border payments. This will enable users with a single eKYC to switch between banks without the need for multiple registrations.

For Cambodian migrant workers in neighbouring countries, Bakong will also enable payment solutions locally. Malaysia is already part of the cross-border network through the partner bank, MayBank.

The Bakong project’s success is paving the way for other Asian countries to explore hybrid payment solutions on blockchain. Taking lessons from Bakong’s best practices, the global shift towards digital currencies will get a further fillip.

Stay up to update with our latest news.

Have Us Contact You