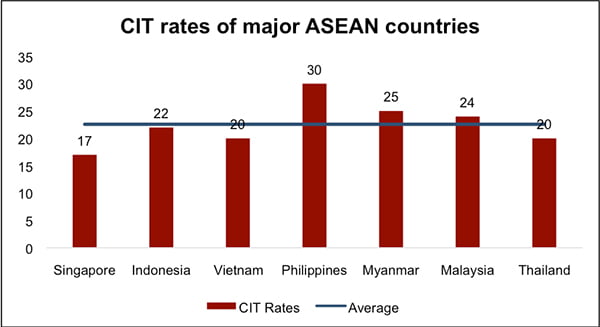

Corporate Income Tax (CIT) – The prevailing standard CIT rate in Myanmar is 25%. Following is a comparative overview of seven major ASEAN economies. On comparison we see that the corporate income tax rate the second highest among these seven countries, and is also above the average tax rates. These comparisons show that Myanmar isn’t very tax amicable in the ASEAN. For the last 5 years the tax rate has remained constant at 25%.

Furthermore, for non-resident foreign organisations registered under the Myanmar CA or Special Companies Act, such as a branch of a foreign company are also charged 25%. A 2% advance corporate income tax is levied on the import and export of goods, and the tax is creditable against the corporate income tax liability of a resident entity at the end of the year. Companies listed on the Yangoon stock exchange are taxed at a reduced rate of 20% on the net taxable profits.

For further information on the tax structure prevailing, refer to the link below:

https://taxsummaries.pwc.com/myanmar/individual/taxes-on-personal-income

Stay up to update with our latest news.

Have Us Contact You