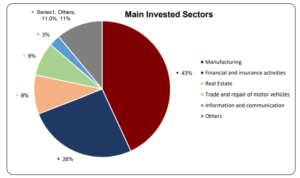

FDI by sector – Foreign Direct Investment net inflows in Thailand equalled US$ 2.48 billion in the year 2021 with ‘Manufacturing’ and ‘Financial and insurance activities’ receiving nearly 70% of total FDI. Manufacturing was a clear favourite among foreign investors, far surpassing the investments received by other sectors. Chart 1 below, indicates the five main invested sectors in 2018, and their respective investment shares. It is important to note that foreign investors were quite attracted to the Financial Services sector in Thailand, a country not usually deemed a financial centre in the region. This might be an indication that the region’s set of financial capitals – which has historically included only Hong Kong and Singapore – could be expanding.

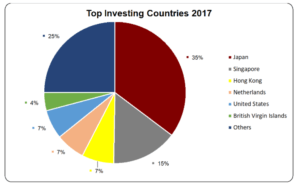

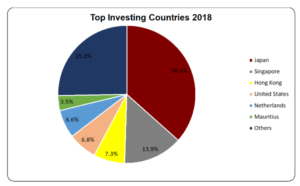

FDI by country – – As Thailand continues to attract FDI, it is important to analyse which countries are most invested in its economy. Charts 2, 3 and 4, as seen below, indicate the main investing countries over a three-year period from 2016 to 2018. Thailand’s regional peers have historically led the way with Japan consistently placing as the top foreign investor in the country’s economy. However, Thailand has also received significant investment from western powerhouses like the United States and the United Kingdom, giving it a truly diverse base of economic backing.

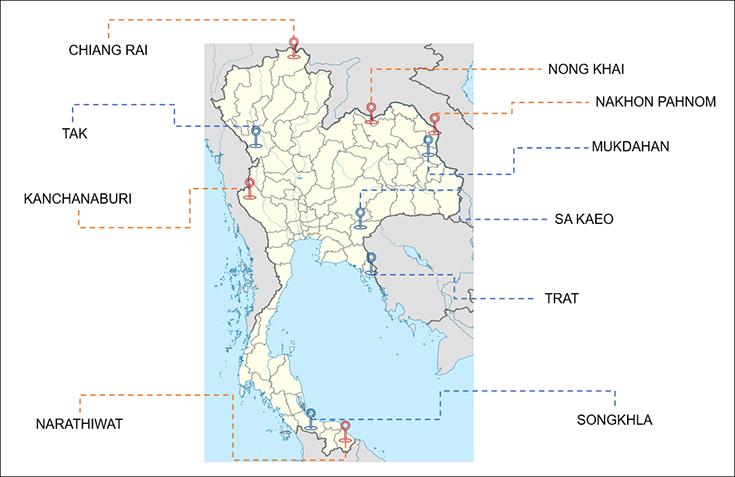

Special Economic Zones –Businesses and investors running business in the Special Economic Zones are benefitting from higher levels of cross-border trade and economic growth. These SEZs are in 10 provinces around Thailand, as shown in the map below, and their proximity to neighbouring countries affords them the benefit of large pools of labour. The Thai government has also relaxed rules on foreign labour to support these SEZs and has identified specific target industries for each SEZ based on unique geographical strength and locally available resources. Most of the target industries are labour-intensive ones, including garment, agriculture, fishery, furniture, logistics, bonded warehouses and tourism. SEZs are, therefore, an attractive option for foreign investors looking to enter Thailand and the map below can, thus, serve as a geographic guide on where to invest.

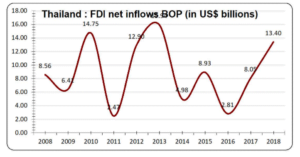

FDI growth over time – FDI net inflows in Thailand have grown by a commendable 57% over the ten-year period from 2008 to 2018, despite having followed an erratic path characterized by major highs and steep falls – particularly in the years 2011, 2014 and 2016. These abrupt changes could potentially have been caused by the 2011 floods that Thailand suffered though, and the political instability that started with a military coup in 2014 and lasted till the democratic elections of 2019. The graph below depicts this uneven trail of foreign investment. Thailand’s turbulent journey, however, has not deterred foreign investors as data reveals that FDI net inflows have surged since 2016, growing by over 370%. This demonstrated that Thailand does have the capacity to generate tremendous net inflows of FDI.

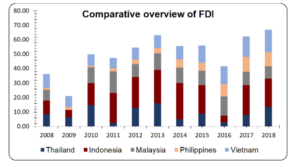

Despite rapidly rising FDI net inflows, Thailand has some way to go when compared to other emerging markets in the region. A comparative analysis of five major ASEAN economies, as seen in the chart below, reveals that Thailand has consistently placed behind Vietnam and Indonesia in the eyes of foreign investors, sometimes receiving the least FDI net inflows of all five countries.

Stay up to update with our latest news.

Have Us Contact You