For emerging markets, success in the 21st century hinges sufficiently on the ability to generate digital prowess. In this regard, Malaysia holds a distinct advantage over many of its regional peers, boasting an internet ecosystem that trumps those in other ASEAN emerging markets. With rapid innovation taking place in competing economies like Indonesia and Singapore, Malaysia must capitalise on its strong foundation to establish itself as a leading digital economy.

As showcased in the figure below, Malaysia’s internet penetration rate of 83% is far higher than the rates prevailing in other Southeast Asian developing nations. This puts Malaysia in a position to launch innovation-backed growth that capitalizes on the country’s 25.6 million internet users. It is also important to note that Malaysia, though a developing economy, is almost at par with Singapore and Hong Kong in its internet penetration rate, and this is a testament of the progress that Malaysia has made as a country.

The year 2020 saw Malaysia’s internet economy accumulate a Gross Market Value (GMV) of US$ 11.4 billion. There are four segments to the internet economy:

The figure below provides the internet economy size in each of six major ASEAN markets, as well as the projected internet economy GMV for each country in the year 2025. In spite of its considerable size, the Malaysian digital economy is smaller than those of its regional peers – barring Philippines. However, the country’s internet economy is expected to grow by over 140% in the next five years, offering a potential vault of opportunity to foreign investors.

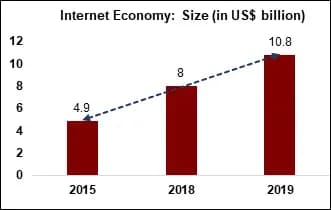

The Malaysian internet economy has evolved into a heavy-weight growth generator, more than doubling in size since 2015. As showcased in chart 1 below, the digital economy’s Gross Market Value has increased by nearly US$ 6 billion in a period of just four years. But which segments of the economy have driven this tremendous growth?

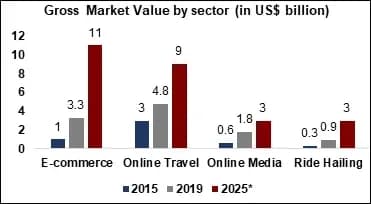

Data reflected in chart 2 tells a story of E-commerce supremacy. Though the E-commerce sector is currently the second largest segment in the digital economy – behind Online Travel – it has exhibited the most explosive growth, having increased in size by 230%. Furthermore, it is expected to become the largest individual segment of Malaysia’s internet economy by 2025, thus, making it a key sector of interest for foreign investors.

The start-up environment in Malaysia is bustling with potential and, despite the absence of a home-grown Malaysian unicorn, there are several companies that are catching the eyes of investors. Some promising stars of the country’s digital ecosystem are as follows:

Name – iFlix Total Funding – US$ 298 million Business outline – iFlix is an entertainment service – targeted at emerging markets – which provides access to a compelling selection of TV shows, movies, hyper local originals, premium live sports and up-to-the-minute news from around the world, to stream or download, on any internet connected device.

Name – Carsome Total Funding – US$ 27.4 million Business outline – Carsome is a selling platform that also functions like a broker for cars. Anyone who needs to sell a car can get in touch with the company, which will inspect the vehicle for free and assess its value. The platform assures customers that the pricing is totally transparent and free of hidden charges and mark-ups. To prove this, it allows the seller to log in and view live bidding results. As a bonus, Carsome handles all paperwork, which it promises to complete within five days.

Name – Kaodim Total Funding – US$ 11.6 million Business outline – Kaodim offers a digital platform that works as a service marketplace, linking users with trustworthy, verified service professionals in cleaning, plumbing, photography, catering, fitness coaching and a wide array of other trades

Name – Jirnexu Total Funding – US$ 27 million Business outline – Jirnexu provides customer acquisition and life cycle management solutions to banks, insurance companies, and service providers. It began with offering financial comparison websites, but it eventually evolved to a streamlined process that allows customers to select and apply for financial products with ease.

Name – iPrice Total Funding – US$ 9.8 million Business outline – iPrice helps online shoppers to compare prices, discover products, and obtain deals from the region’s best online shops. By doing so, it aims to be a one-stop shopping destination for shoppers all over Southeast Asia.