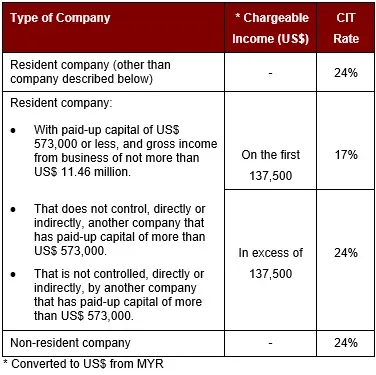

For both resident and non-resident companies, corporate income tax (CIT) is imposed on income accruing in or derived from Malaysia. The current CIT rates are provided in the following table:

On comparing Malaysia to other major economies in ASEAN, we find that the Malaysian CIT rate stands out. As showcased in the graph below, Malaysia has the 3rd highest CIT rate among Southeast Asia’s largest economies, much of a contrast to its southern neighbour Singapore. As foreign investors flock to Southeast Asia, Malaysia’s higher-than-average CIT rate may become a relevant point of consideration.

To learn more about Malaysia’s Corporate Tax structure, follow the link below: https://taxsummaries.pwc.com/malaysia/corporate/taxes-on-corporate-income

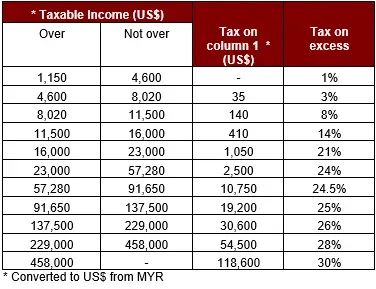

The PIT rates for individual income are as follows:

To learn more about Personal Income Tax in Malaysia, follow the link below:

https://taxsummaries.pwc.com/malaysia/individual/taxes-on-personal-income