Vietnam is considered one of the most efficient power markets in Southeast Asia. The country has achieved around 99 percent electrification with relatively low cost in comparison to neighboring countries.

With development and industrialization, as energy demand skyrockets, Vietnam is predictably experiencing a shortfall in supply. The demand is predicted to increase by over 8% per annum during the 2021-2030 period from 265-278 TWh in 2020 to 572-632 TWh in 2030. As per multiple online reports, to meet the growing demand, Vietnam needs 60,000MW of electricity by 2020, 96,500MW by 2025, and 129,500MW by 2030. To do so, the country needs to increase its installed capacity by 6,000MW – 7,000MW annually and spend close to US$148 billion by 2030. By the end of 2022, the total number of power plants in operation was 360, with a total installed capacity of 80597MW.

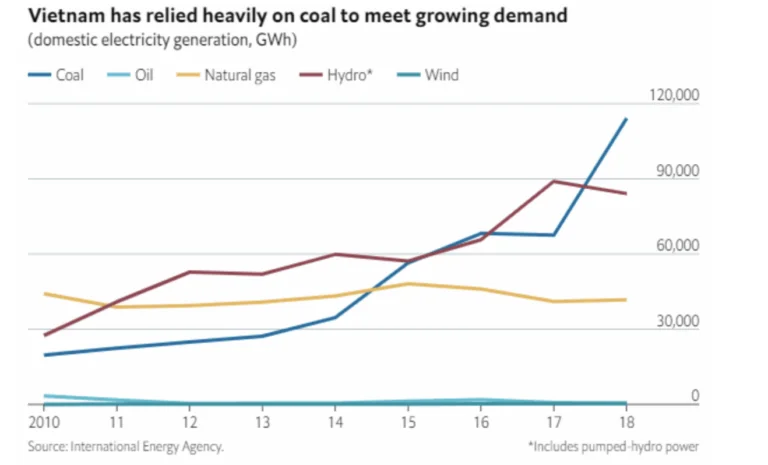

While, energy sources are diverse in Vietnam including coal, oil, natural gas, hydropower, and renewable energy, as per latest 2019 Vietnam Electricity Annual Report, hydropower and coal-fired power continue to lead among power generation sources. This is likely to remain the case in the medium term as demand grows strongly. Power Development Plan (PDP) VII (updated in 2016), authorised the energy sector to meet incremental demand by continuing investing heavily in coal plants and importing thermal coal.

However, though as a policy initiative, PDP VII could have done much more for wind and solar power, it did announce some initiatives to increase the electricity output produced from renewable sources from approximately 58 billion kWh in 2015 to 186 billion kWh by 2030 and reduce the use of imported coal-fired electricity amid energy security and environmental and sustainability concerns.

While gig jobs offer flexibility, they are also open to exploitation and abuse. A report by ILO pointed out that the digital divide, lack of unionization, privacy issues, and competition are among the rising issues in this space.

Addressing this, Singapore already has set up an Advisory Committee with aims of protecting the gig workers. Other countries should soon follow suit. The job market in ASEAN is expected to make a slow recovery from COVID-led unemployment. Gigs here can help bridge the pay gap among middle-income and lower-middle-income workers. But for the ecosystem to truly thrive, worker wellbeing needs to be given equal importance.

Recently, both solar and wind generation sources have been attractively promoted. A feed-in tariff for solar was introduced in 2017 resulting in Vietnam’s installed solar capacity increase from non-existent at the start of 2018 to 8.5 GW by end 2019 (including the 3 GW awaiting grid connection), which has far exceeded the original goals of PDP VII. Additionally, a feed-in tariff scheme for wind power that will apply to any projects that commence commercial operations by the end of 2023 has also helped projects: in June 2020 the government approved new wind projects totaling 7 GW, which will be installed over the next few years

To keep up with demand, as per a McKinsey report, the country will need significant amount of new capacity, requiring US$150 billion in capital investments for generation and grid upgrades, according to Electricity of Vietnam (EVN’s) estimates. As per some estimates, the funding for renewables required would be around US$ 23.7 billion by 2030.

With such high capital requirements, the government has allowed 100 percent foreign ownership of Vietnamese companies in the energy sector, joint venture or public-private partnership (PPP) in the form of a BOT contract among other reforms. PPP projects in the form of build-operate-transfer (BOT) contracts are preferred due to government guarantees and incentives. Renewable energy projects gain additional benefit in the form of import duty exemption for imported goods, tax incentives and other policy incentives including preferential credit loans, land use tax exemption, and land rental exemption.

To ensure consistent returns for investors, the government has also approved standardized power purchase contracts (20 years). It has also allowed solar power developers to bypass the state-owned power company, Electricity Vietnam (EVN), by selling power directly to manufacturers. Also, EVN, which is the sole buyer of electricity in the country, has also been told to prioritize renewable energy.

However, though policy initiatives have been encouraged, the implementation and ground realities continue to put obstacles for investors in the form of

The Economists’ EIU reports that the new draft of PDP VIII (2021), which has been given approval by the prime minister, lays out national energy goals up to 2045. The provisional plan states that 18 GW of coal-fired power plants will be completed before 2026, but there will be no new coal projects in 2026-30. New technological solutions will be integrated resulting in less pollution per energy unit. Wind and solar power installations is expected to be rolled out to reach a planned 28% of total capacity by 2030. Further, the government could consider the following:

Stay up to update with our latest news.

Have Us Contact You

© Copyright ASEAN Business Partners 2025 I Sitemap I Privacy Policy