Indonesia, a nation rich in natural resources, presents a compelling opportunity for mining companies. With abundant reserves of coal, nickel, tin, copper, and gold, the sector plays a vital role in the country’s economy. However, navigating the Indonesian mining landscape requires a deep understanding of the regulatory environment, market dynamics, and potential challenges. This article provides a comprehensive guide for companies seeking to unlock the potential of Indonesia’s mining sector.

1. Nickel

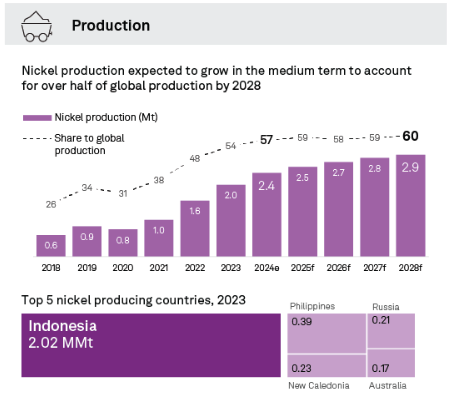

The global nickel market is projected to experience significant growth, primarily driven by the burgeoning electric vehicle (EV) industry. Indonesia is the world’s largest nickel producer, accounting for over 50% of global mine production in 2023. Continued strong growth is expected, fuelled by EV demand and ongoing downstream processing investments in Indonesia. Indonesia’s supply dominance exerts significant influence on global nickel prices. The government’s emphasis on downstream processing (NPI, nickel sulphate) is crucial for long-term growth and value capture. Nickel prices are subject to significant fluctuations due to factors like EV demand, global economic conditions, and geopolitical events.

2. Coal

The global coal market is facing challenges due to the transition to renewable energy sources. Indonesia is a major coal producer and exporter. While global demand may decline, Indonesia’s coal industry is expected to continue playing a role in domestic energy production and regional exports. The coal industry faces increasing scrutiny due to its environmental impact. The long-term outlook for coal is uncertain as the world transitions towards cleaner energy sources. Domestic demand for coal-fired power generation will continue to drive production in the near term.

3. Gold

The global gold market is driven by factors like jewellery demand, investment, and central bank purchases. Indonesia is a significant gold producer. Global demand for gold is expected to remain robust, providing a stable market for Indonesian producers. Increased exploration efforts are crucial to sustain gold production in the long term. Competition from other gold-producing countries will remain intense.

4. Copper

The global copper market is experiencing strong growth driven by the electrification of the global economy (renewable energy, electric vehicles, infrastructure). Indonesia is a growing copper producer. Strong and sustained demand for copper is expected in the coming years, presenting significant opportunities for Indonesian producers.

The central government oversees the licensing of mining businesses. This licensing process encompasses:

The RKAB serves as a crucial document that outlines a mining company’s operational plans for a specific period. It details aspects such as the planned production volumes of minerals, financial projections, mining methods, processing techniques, transportation logistics, plans for environmental protection and programs for local community development and social responsibility.

An approved RKAB is mandatory for mining companies to operate legally in Indonesia. It serves as a roadmap for the company’s operations, ensuring that activities are conducted in a planned and organized manner, enhancing transparency and accountability by outlining the company’s plans and commitments to the government and stakeholders.

The 2009 Mining Law categorizes mining permits/licenses into three primary types:

License extensions for state-owned enterprises (SOE’s):

By carefully navigating the regulatory landscape, prioritizing downstream investments, and building strong relationships with stakeholders, companies can unlock the significant potential of Indonesia’s mining sector. Conducting thorough due diligence, mitigating risks, and embracing sustainable practices are crucial for long-term success in this market.

Entering a market like Indonesia—or any Southeast Asian country—can be a complex journey, but you don’t have to go it alone. That’s where we step in.

With our deep expertise in market research, regulatory compliance, tailored entry strategies and understanding of local stakeholders we provide the tools and insights you need to succeed in Indonesia’s Mining sector. Whether it’s navigating regulations, analysing industry trends, or building relationships with key stakeholders, we’re here to be your trusted partner.

Ready to tap into Indonesia’s Mining potential? Let’s work together to turn your Southeast Asian ambitions into reality.

Stay up to update with our latest news.

Have Us Contact You

© Copyright ASEAN Business Partners 2025 I Sitemap I Privacy Policy