Thailand’s agro-processing industry stands out as one of the most dynamic sectors in Southeast Asia, benefiting from the country’s strong agricultural base, strategic location, and government-backed initiatives aimed at modernizing agriculture. This article delves into the opportunities and challenges that foreign investors face when entering Thailand’s agro-processing industry.

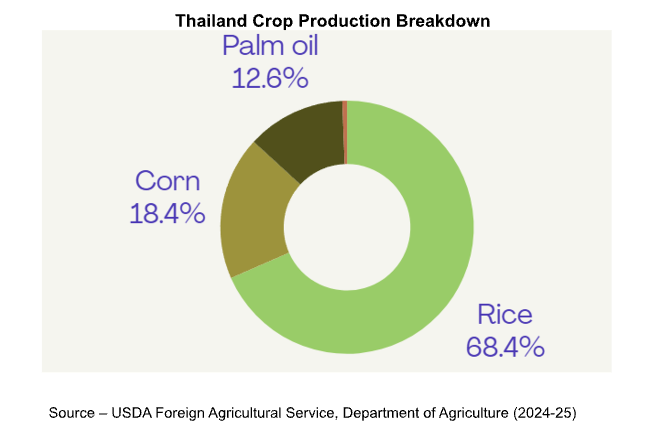

The agro-processing sector in Thailand is a cornerstone of the country’s economy, contributing approximately 8.5% to the GDP. The country’s agricultural production is diverse, ranging from rice, rubber, palm oil and sugar to fruits like durian, mango, and pineapples. Thailand has a population of 71 Million of which 37% are considered to be middle class. Due to this, the local consumption of agricultural produce is very high with a majority of Thai people enjoying staples like rice and seafood on a daily basis. Thailand is also the world’s largest exporter of processed rice, tuna, and shrimp, and has a significant position in processed food exports, thanks to its vast coastal areas and extensive shorelines that provide abundant marine resources. This geographical advantage, combined with a robust seafood industry infrastructure, has positioned Thailand as a global leader in seafood production

Thailand’s agro-processing sector presents significant opportunities for international agri-tech firms, driven by robust government support, rising consumer demand for processed foods, and a commitment to sustainable agricultural practices. By investing in technology, automation, and green innovations, foreign firms can tap into a rapidly growing market. However, navigating Thailand’s regulatory landscape, competitive environment, and infrastructure challenges will require strategic planning and local partnerships.

In conclusion, Thailand remains a strategic entry point for global agri-tech companies aiming to establish a presence in Southeast Asia’s growing agro-processing industry, with strong export potential and opportunities for innovation across the agricultural value chain.

Stay up to update with our latest news.

Have Us Contact You

© Copyright ASEAN Business Partners 2025 I Sitemap I Privacy Policy