Indonesia’s relevance in the global economic landscape will be determined by its embrace of the future. In this age of digitization, the internet economy is of supreme importance as it may very well define the remainder of Indonesia’s growth story. On this front, Indonesia has made some sweeping advancements, metrics of which are as follows:

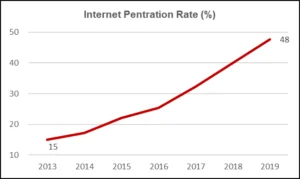

Internet Penetration Rate – As of 2019, Indonesia had an internet penetration rate of 48%, thus, offering nearly 129 million people to shoulder digital growth. Relative to other countries of comparable economic stature, we find that Indonesia still has significant room for improvement. This is displayed in figure 1. However, the rapid rate at which the Indonesian people are adopting digitization is remarkable. As we can see from figure 2, in just the last seven years, Indonesia has more than three times its internet penetration rate. If this trend were to continue, Indonesia could become the hotspot for technological investment in the future.

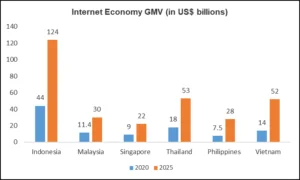

Internet Economy size – In 2020, the internet economy of Indonesia had a Gross Market Value of US$ 44 billion. There are four segments to the internet economy:

As the largest emerging market in South East Asia, Indonesia’s internet economy far surpassed those of its neighbors. The chart below depicts the Gross Market Value in 6 major ASEAN nations, indicating the actual value in 2020 and the predicted value for the year 2025. The Indonesian internet economy is more than twice the size of any of its peers’ and is expected to grow by over 200% in the next 5 years, making it a treasure trove of opportunity.

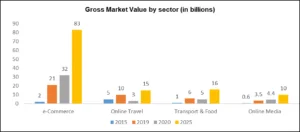

Growth over time – The internet economy in Indonesia has grown exponentially since 2015, showcasing a remarkable 450% increase in Gross Market Value over the last five years. The key question, however, is which segments of this economy have performed the best?

As the graph below indicates, the e-commerce sector has shown the most growth of all digital sectors since 2015. E-commerce is now the largest contributor to Indonesia’s internet economy, a pedestal formerly occupied by Online Travel. While considerable growth is expected across all four segments, E-commerce will continue dominate the market.

Major Players in the digital space – South East Asia is home to 12 unicorns, and nearly half of these are based in Indonesia. Second only to Singapore, Indonesia is leading the region in start-up success stories, and this is testament not only to the entrepreneurial drive that has cultivated in the nation but also to the innovation that is being spurred there. The four unicorns and one decacorn in Indonesia are as follows:

To learn more about the Digital economy in Indonesia, follow the link below:

https://www.blog.google/documents/47/SEA_Internet_Economy_Report_2019.pdf

Stay up to update with our latest news.

Have Us Contact You

© Copyright ASEAN Business Partners 2025 I Sitemap I Privacy Policy