Profit tax is levied on income. Small and medium enterprises that are not registered under the Value Added Tax (VAT) system are subject to lump-sum tax instead of profit tax. This applies to enterprises which have annual revenue of less than LAK 12 million. A 24% profit tax rate applies to both domestic and foreign businesses, except for companies registered on the Lao Stock Exchange, which benefit from a 5% reduction of the normal rate for a period of 4 years from the date of registration on the Stock Exchange. After this period, the normal profit tax rate applies. A 26% profit tax rate applies to companies whose business is to produce, import, and supply tobacco products. 2% of the tax paid by tobacco companies shall be contributed to the Cigarette Control Fund (Article 46 of the Law on Tobacco Control). Small and medium enterprises that are not registered under the VAT system pay lump-sum tax at progressive rates between 3%-7%, depending on the nature of the business and its revenue.

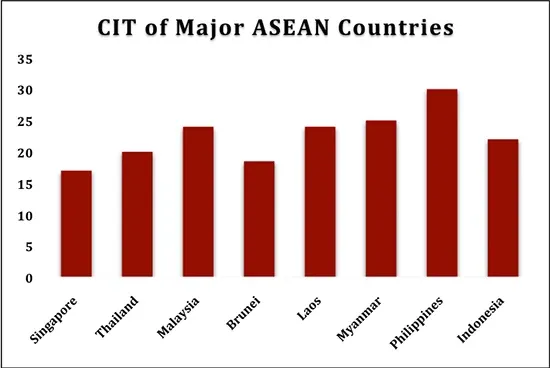

From the above table it seen that Laos has the third highest tax rate in the ASEAN along with Malaysia at 24%. This shows that Laos isn’t one of the most tax amicable countries in the ASEAN.

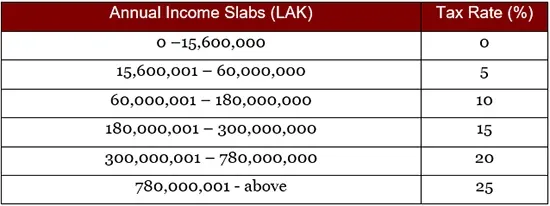

The personal income tax rates (PIT) in Laos follow a progressive nature. The annual PIT rates for both Lao and foreign individuals is as follows:

Dividends (including share in partnership income) received are subject to dividend WHT at the rate of 10%. Interest on bank deposits are exempt from income tax. There are no provincial or local income taxes in Lao PDR. The Profit Tax rates are as follows: