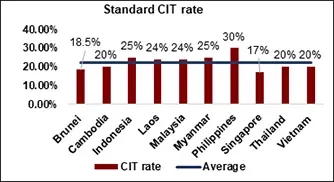

As we can see in the chart below the standard Corporate Income Tax rate in Cambodia is 20%. In comparison to the other ASEAN countries it is one of the lowest and it is below the average ASEAN CIT rate which is 22%. Oil and Gas and a business of mineral exploitation activities are subject to a 30% tax rate. Insurance is granted a 5% tax rate.

In Cambodia the PIT rate for non-residents is flat at 20% and for residents it is progressive and lies between 0% – 20%. The rate is charged as shown in the table below-