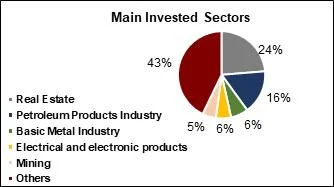

FDI by sector – In 2019, FDI net inflows into Malaysia stood at US$ 73.33 billion, granting the most benefit to the country’s Real Estate sector which received nearly 24% of total foreign investment. As shown in chart 1 below, the Malaysian Petroleum Products Industry was the second most sought after sector by foreign investors, garnering over 16% of total FDI.

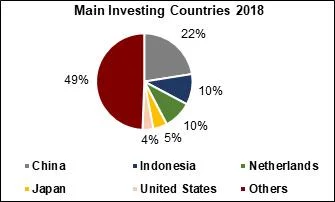

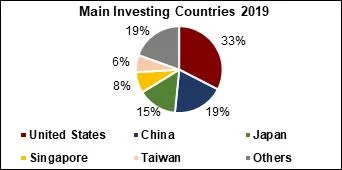

But which countries have been most keen on the Malaysian economy and has there been a change in the members of this group over time? Charts 2 and 3 helps in answering these questions. As shown in chart 2, China was the single largest foreign investor in the Malaysian economy during 2018, but a year later that top spot was occupied by the United States. Furthermore, by 2019, Indonesia and Netherlands were no longer among the five main investing countries, having been replaced by Singapore and Taiwan.

Japan, however, continued to show its faith in the Malaysian economy, becoming the 3rd largest foreign investor in the country and contributing nearly 15% of total FDI in 2019.

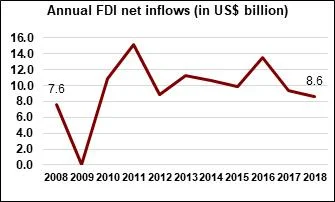

FDI growth over time – FDI net inflows in the Malaysian economy have followed a rocky path since 2008, ebbing and flowing through a tumultuous ten-year journey. As showcased in the graph below, foreign investment in the country took major blows particularly in the years 2009, 2012, and 2017. The dip in 2009 was likely caused by the global financial crisis, whereas in 2012, economic turmoil in Europe (particularly Greece) may have adversely impacted major foreign investors, thus resulting in a steep fall. Then onwards, FDI remained stable for four years, but it suffered another blow in 2017, owing, perhaps, to the 1MDB financial scandal and the consequent political instability in the country. With uncertainty continuing to surround politics in Malaysia, the confidence of foreign investors may require tending to.

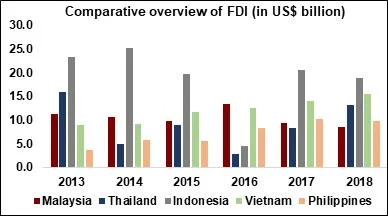

In the first half of the decade, despite the turbulence in FDI, Malaysia remained among the top choices for foreign investors looking to enter South East Asia’s emerging market landscape. However, that trend seems to have been dissipating since 2017 because Malaysia has been falling behind many of its regional peers in attracting foreign investment, as seen in the figure below.

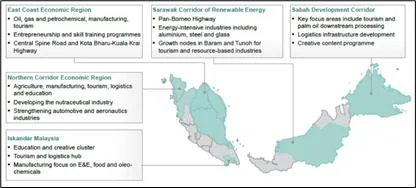

Investment Corridors – Malaysia hosts five investment corridors across its geographic landscape. While each of these corridors, as depicted in the figure below, has its own benefits, the two main corridors are the East Coast Economic Region (ECER) and the Iskandar SEZ. The ECER hopes to attract 120,000 new jobs and US$ 16 billion in investments by 2025, and in order to make this hope a reality, it proffers investors with competitive incentives such as an income tax exemption of 100% for 10 years and stamp duty exemption on land or building purchased for development.

The Iskandar SEZ is also an economic goldmine. It generated almost 2 million jobs in 2018 and has positioned Malaysia’s east coast as a key area for the development of ASEAN free trade. Since its birth in 2006, the region has grown by 100% and is currently on course to hit its investment target of US$ 91 billion by 2025.

Stay up to update with our latest news.

Have Us Contact You

© Copyright ASEAN Business Partners 2025 I Sitemap I Privacy Policy