In Q2 of 2020, one of the clothing sites Zalora, recorded two million downloads of its app, about 7-12% increase in share of new customers in revenue. Recently the company’s COO Rostin Javedi said that COVID-19 has changed shopping behaviour and it only looks brighter for online marketplaces Southeast Asia.

COVID-19 changed the way we interact in the social and cultural space, our habits and most importantly, our purchase decisions. All these changes were necessary to protect ourselves during this global crisis that posed logistical constraints like social distancing, limited retail hours and overcrowding during the open hours. With medical research still in its nascent stage, there was no better option than to rely on technological affordances. But as the saying goes, every crisis presents and opportunity and the e-commerce sector has epitomized this phenomenon. The maturity of the market has improved by several folds, especially in the urban or over-populated areas.

Based on an internal case study of ASEAN Business Partners’ team members in Indonesia, Philippines, Singapore and Vietnam, we found that there was an increase in e-commerce usage and atleast five new apps ranging for fintech, retail, logistics and health etc. were explored. This could be because many “essential supply” goods and services started taking their businesses online during the pandemic.

Super App market is forecasted to be at US $23 billion in 2025. Some of the important services in this segment are ridesharing, food delivery, fintech, digital banking, e-commerce. Super Apps generally create a strong engagement with different businesses through the app all day. Over US $43 billion has been spent on Super Apps across ASEAN, China gets about 6x this number. Of the Super Apps services, fintech may be the biggest disrupter as this would be the entry point for other services.

Luxury brands are also finding place buyers online especially for clothing. Some of the respondents said that they would buy a product without touch and feel if it came from the brand’s website. Others said that they would spend upto USD 1000 and this threshold amount has risen during the pandemic. One of the e-commerce sites reported that their customer-base is that of 25-35 age group for luxury segment and unique luxury buyers were on an average 36 and above. This is very much in line with ASEAN’S average age of the population.

An e-Conomy SEA report by Google, Tamasek, says that 40 million people in Indonesia, Malaysia, Singapore, Thailand, the Philippines and Vietnam came online for the first time during the pandemic until November 2020. The internet users in the region rose upto 400 million from 250 million five years ago. What could not be achieved in a decade of existence of e-commerce was achieved in a few months into the pandemic. In 2020, Southeast Asia clocked over 11% of the world’s app downloads and Indonesia was leading with a global share of 4%, the highest in the region. The region is becoming a mobile-first region as more activities migrating to mobile from gaming and entertainment to communications, finance and payments.

With four of its publishers in the top 10 ranking including Amanotes, OneSoft, VNG and BACHASoft, Vietnam market has gained an edge over the others in ASEAN. Vietnam’s Momobank is looking to start digital banking which also is a huge driver of online goods and services consumption.

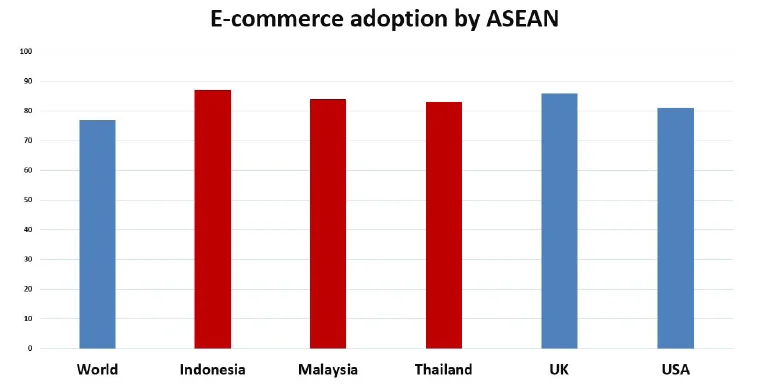

Many ASEAN countries outpaced developed countries and exceeded the world average of 77% in using e-commerce.

Digital retail in Southeast Asia grew 85% year-on-year. About 80% of consumers are expected to go digital by the end of 2021. The e-Conomy report also says that the digital spending has increased by 60% from what it was in 2019. People are spoilt for choice with new products and services, 51% said that they tried newer online stores in 2020 than ever before.

Among the ASEAN countries, Indonesia, followed by Philippines and Malaysia have seen highest e-Commerce adoption. ABP’s internal survey showed that a bulk of the e-commerce in the ASEAN happens on mobile e-commerce platforms, what with increasing availability of affordable smartphone devices.

The best part is that the e-commerce story in the ASEAN region has just been scripted and bigger picture is set to emerge as the world moves on beyond COVID. Today, consumers are said to be making conscious purchase decisions by navigating through 7.9 websites as opposed to 5.2 in 2020. Eco-friendly, sustainable and socially responsible products are gaining more traction with 80% of the consumers ready to pay higher charges that come with this segment.

Stay up to update with our latest news .

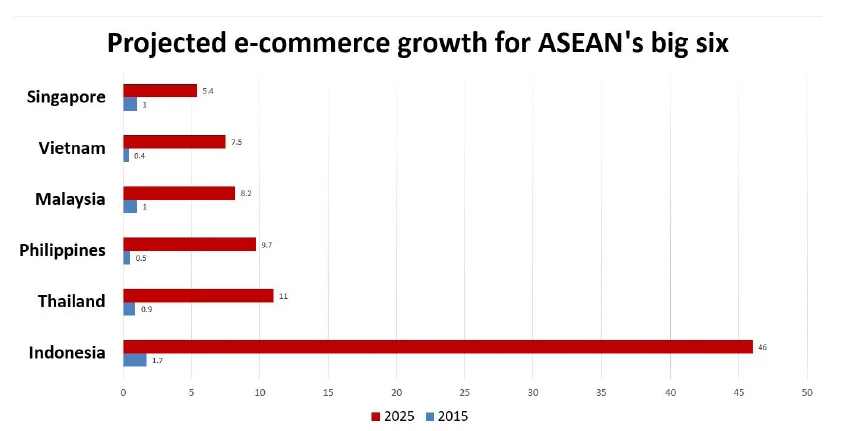

Home to a population of over 660M in 2020, and with one of its members, Indonesia, fourth most populous country in the world, it is not hard to imagine the explosive growth of e-commerce in the ASEAN region in the years to come.

The mighty push to e-commerce, which grew at a blistering pace to six times in this region during four years’ time- from just US$ 9.5B in 2016 to US$ 54.6B USD 2020. It is is expected to grow at an annual rate of over 20% and touch close to US$ 150B by the year 2025.

The demographic advantage of a young population, ever increasing standard of living of its people and a remarkable continuity and support of the governments embracing new technologies to bridge the digital divide and connect more of its populace with the digital world will provide the impetus to growth of e-commerce in ASEAN.

At the same time, with a diverse cultural fabric, a one size fits all approach to e-commerce may not work and homegrown e-commerce companies will spur the growth along with monoliths like Amazon, E Bay, etc. who also will have to adapt themselves to meet the needs of a diverse ASEAN market.

Have Us Contact You

© Copyright ASEAN Business Partners 2025 I Sitemap I Privacy Policy