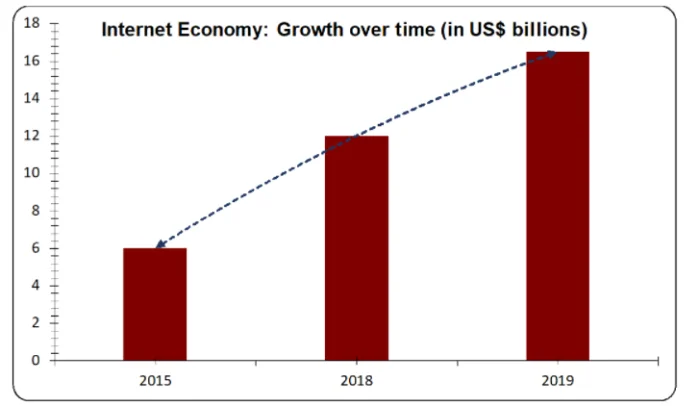

Major players in the digital space– Despite significant growth the Thai internet economy is yet to produce its first unicorn. However, Thailand is home to several promising start-ups that could go toe-to-toe with regional giants like Grab and Gojek in the near future. Some of them are listed below