The Russia-Ukraine war has impacted sunflower oil sowing season. Now palm oil could come to the rescue.

Chocolate biscuits, bread, ice cream, potato chips, and even instant noodles. Name your favourite food product and it will contain palm oil. Without realising it, we consume 8 kilograms of palm oil annually. But, the last few years have seen a lot of bad press against palm oil. It has been held responsible for the deforestation of many biodiverse forests.

And in this, sunflower oil, oftentimes, has been used as an alternative to palm oil. Now, with the Russia-Ukraine war coming in the way of the export of sunflower oil, palm oil is having a ‘Dark Knight Rises’ moment. It is filling in the gaps in the edible oil market.

Every year, close to 20 million metric tonnes of sunflower oil is produced, with Ukraine and Russia being the two largest producers. 2022 was an aberration. The Russia-Ukraine war led to the sowing season being impacted by the attacks.

With the two countries, that account for 60% of the world’s sunflower oil production, being involved in prolonged conflict, prices shot up in March. Existing produce could also not be exported due to supply chain issues amidst the war. So, every country started looking for an alternative that was cheaper and suitable for use in food and cosmetics. Palm oil could slide in comfortably.

The glossy oil fits perfectly with all kinds of mass-produced food due to its high temperature and neutral taste. And its prices have also stabilised.

The Palm Oil Magic

According to the predictions of the research portal Palm Oil Analytics, the current sunflower oil crisis will lead to Europe becoming the second-largest buyer of palm oil from Malaysia after India.

Since palm oil is also being used to make biodiesel, there is an ongoing debate in Europe about whether edible oil usage in fuel could be temporarily suspended. There is legislation under the EU Renewable Energy Directive through which palm oil as biofuel will be phased out to zero by 2030.

This is amidst a shortage situation in Indonesia. The Indonesian government has decided to restrict palm oil exports to help mitigate the deficit and curb the surge in cooking oil prices.

Experts believe that the supply side deficit will be plugged over the next few months. It is expected that crude palm oil production is expected to show some recovery, especially in the second and third quarters of 2022 to narrow down the demand-supply gap of palm oil. This will also help prices to stabilise.

Thanks to the dearth of sunflower oil and palm oil playing saviour, Indonesia’s exports hit record highs in March amid commodity price rises. March exports from Indonesia were worth $26.5 billion, up 44.4% on a yearly basis on the back of products such as palm oil being in high demand.

With this rise in demand, the global market for palm oil which has been estimated at $74.9 billion in the year 2022 is projected to reach $92.3 billion by 2026.

Making a sustainable switch

While environmental groups have criticised palm oil production citing deforestation, producers are slowly switching to sustainable harvesting.

For instance, certification schemes such as the Malaysian Sustainable Palm Oil (MSPO) certification have regulations for avoiding deforestation, protecting biodiversity, and promoting labour rights.

Similarly, schemes to improve the yield have also come in handy for the plantation farmers. The Malaysian Palm Oil Board is now using a DNA-based screening technology to trace low-yielding non-tenera palms early before field planting, especially at the oil palm seed or seedling stage.

Through this, plantation operators can selectively field-plant the higher-yielding palms, thus increasing fruit production and oil yield without expanding the planted area, or increasing labour and fertiliser costs.

Indonesia too has implemented similar rules to ensure sustainability. Under new regulations, it is not just plantation companies but even small farmers who need to be certified under the Indonesian Sustainable Palm Oil scheme. This mandates farmers to not encroach on forest land to build palm plantations.

In addition, there is also a nationwide plan to replant all ageing trees (above 25 years) with higher-yield seedlings by 2025.

Other studies have also shown that there is an opportunity for an upward shift in existing plantation productivity. This can be done through better utilisation of technology and predictive analysis to map the yields in advance.

Global initiatives have also followed. Conservation organisation WWF has set up the Asia Sustainable Palm Oil Links programme. This aims to remove deforestation from palm oil supply chains and increase sustainable production and consumption of certified sustainable palm oil in Asia.

The programme is being implemented across the two largest palm oil-producing countries (Indonesia and Malaysia), the two largest consuming countries (China and India), and the region’s main trading hub (Singapore). Through this programme, WWF wants to drive sustainable production, trade with a commitment to zero deforestation, and sustainable-certified oil consumption.

Greener pastures are here

With the world at the doorsteps of Indonesia and Malaysia seeking respite from the oil shortage, production is set to rise further.

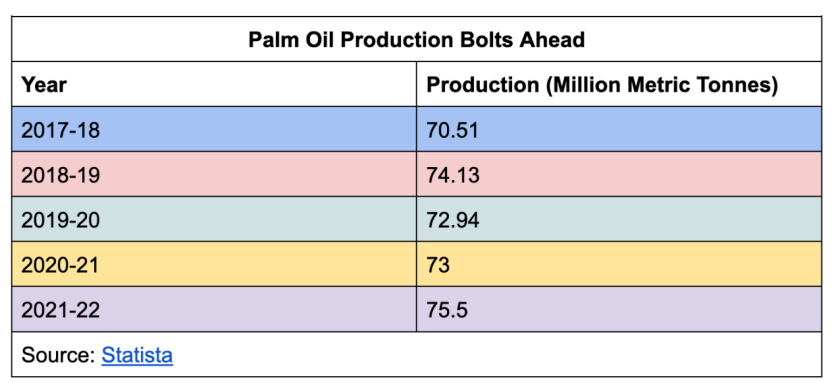

The US Department of Agriculture has raised its global palm oil output. It said that the global palm oil production forecast for the October 2021-September 2022 year is hiked to 77.05 million tonnes. This is compared to the 75.59 million tonnes prediction in its March report.

The return of migrant workers to relieve Malaysia’s plantation labour shortage boosted the production projection for 2021-22 to 19 million tonnes, up from the 18.7 million tonnes forecast in March.

Simultaneously, Indonesian production for 2021-22 was revised up to 45.5 million tonnes from 44.5 million tonnes in March, with milder climatic conditions forecast for the key palm oil growing regions of Kalimantan and South Sumatra.

With sustainable production and consumption at the core, it’s time to take a relook at making palm oil mainstream.

For meaningful progress to take place, the European Union’s free trade policies will need to undergo tweaks to ensure that no commodity is unduly discriminated against. Time and again, it has been the palm cultivation that has helped households across the world access affordable cooking oil.

Existing standards are now being strengthened to meet international requirements. Allowing regenerative agriculture to enable oil palm plantation with other crops on the same land area could help bring a new era of transformation for the industry. A glowing future awaits.

Stay up to update with our latest news.

Have Us Contact You